Dividend growth stocks generally act as a hedge against economic or political uncertainty as these belong to mature companies, which are less susceptible to large swings in the market while simultaneously offer downside protection with their consistent increase in payouts.

Additionally, these stocks have superior fundamentals that make dividend growth a quality and promising investment for the long term. These include a sustainable business model, a long track of profitability, rising cash flows, good liquidity, strong balance sheet and some value characteristics. Further, a history of strong dividend growth indicates that a future hike is likely, which makes the portfolio safer.

Although these stocks do not necessarily have the highest yields, they have outperformed for a longer period than the broader stock market or any other dividend-paying stock.

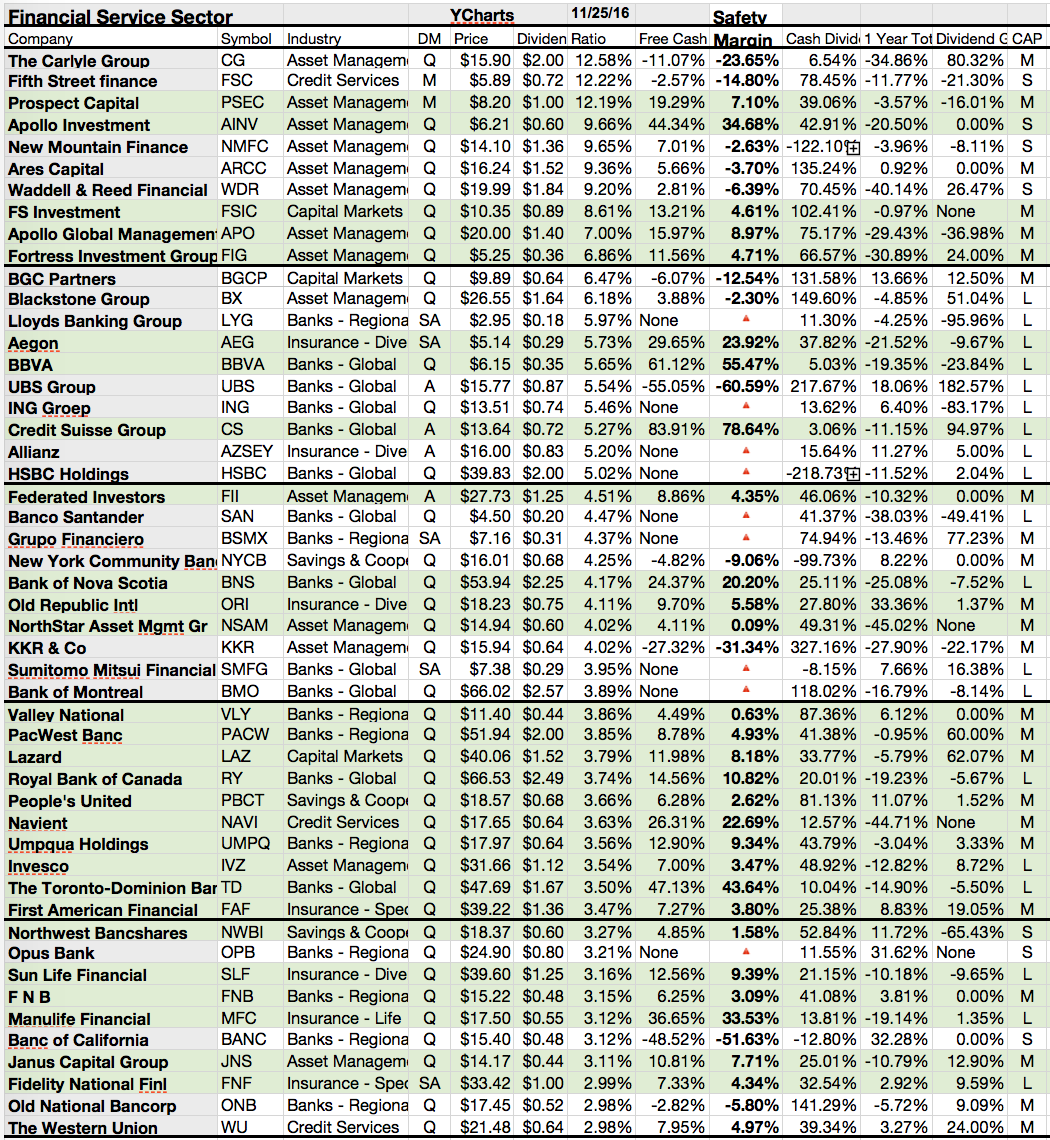

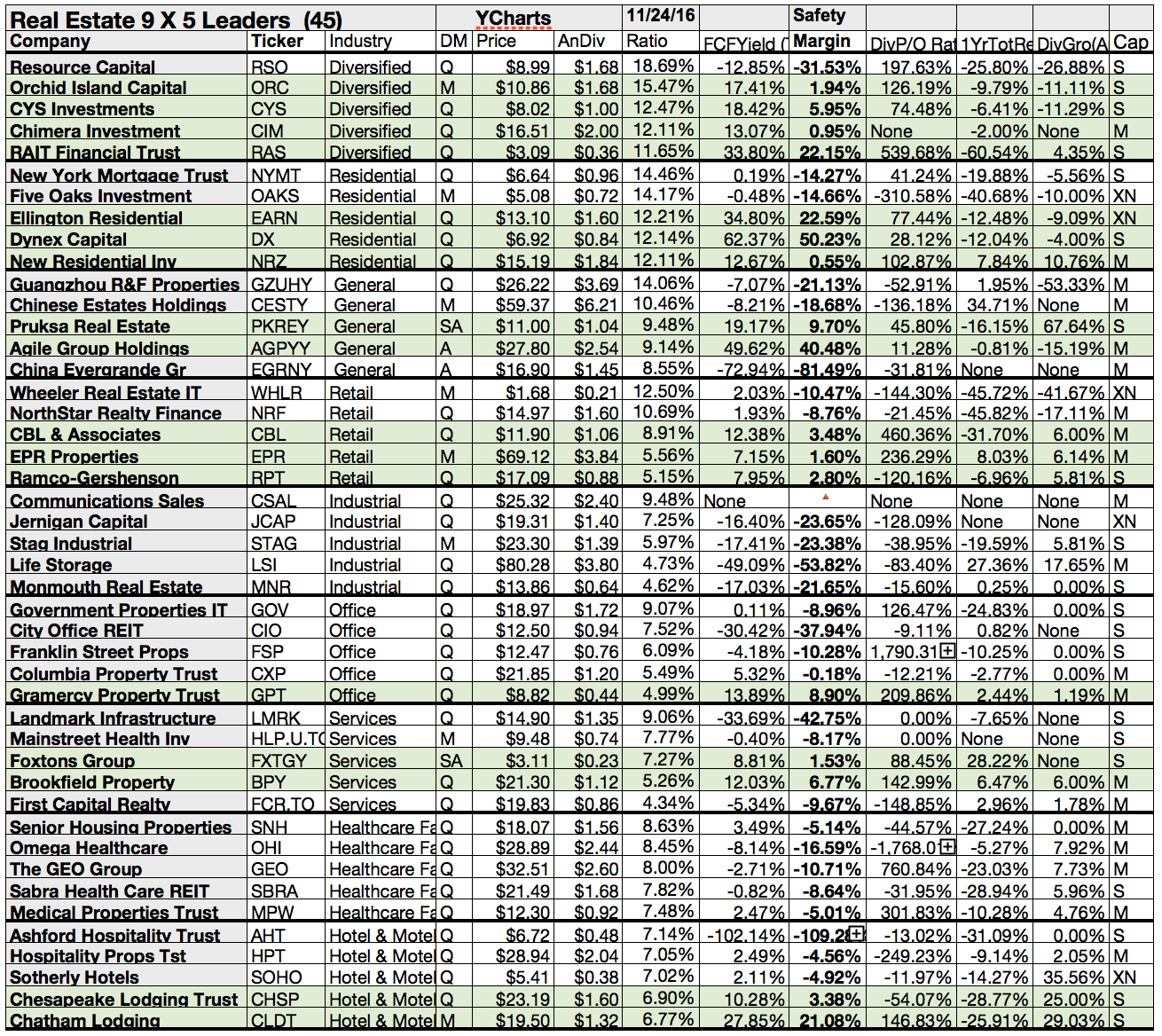

Here are the screening results of our latest dividend growth screen of stock that could deliver solid returns for the mid- and long-term:

5 Top Dividend Paying Champion Stocks To Look For In 2017

For the most part, 2016 has been a good year for the U.S. stock market, with the S&P 500 climbing nearly eight percent.

During this period, dividend investors have also been handsomely rewarded. Many dividend-paying stocks kept their track record of dividend hikes.

At the same time, those high-paying dividend stocks offered a way for income investors to boost the return of their portfolios in this ultra-low-interest-rate environment. With one month to go until 2017, let’s take a look at the five best dividend stocks we like to observe for the next year with hope that they can deliver a solid performance.

Here are the results...

During this period, dividend investors have also been handsomely rewarded. Many dividend-paying stocks kept their track record of dividend hikes.

At the same time, those high-paying dividend stocks offered a way for income investors to boost the return of their portfolios in this ultra-low-interest-rate environment. With one month to go until 2017, let’s take a look at the five best dividend stocks we like to observe for the next year with hope that they can deliver a solid performance.

Here are the results...

20 Highest Yield Dividend Champions

High-growth momentum stocks are nice, but many investors these days are more interested in stability and dependable dividends. If you’re an income-oriented investor, this list of Dependable Dividend Stocks is for you.

Some of these stocks may be boring, some of the yields may not be thrilling and some may not have impressive earnings growth in their future.

But all of these Dependable Dividend Stocks are rock-solid when it comes to preserving capital and making regular dividend payments. Check out the list below and sort by company, yield or dividend history.

"Dividend Champion" is a term orientated strategy referring to U.S Companies that have offered and increased their dividend for a minimum of 25 straight years.

A track record like this is incredibly encouraging to investors who know all to well that a company can cancel dividend payments at any time.

A consistent payment history is all the more important if the yield is competitively high. With this in mind we screened the 104 dividend champions, whose yields range from 0.50% to 5.06% and pulled the top 20 yielders.

Here are the 20 highest yielding Dividend Champions to compare with some essential fundamentals....

Some of these stocks may be boring, some of the yields may not be thrilling and some may not have impressive earnings growth in their future.

But all of these Dependable Dividend Stocks are rock-solid when it comes to preserving capital and making regular dividend payments. Check out the list below and sort by company, yield or dividend history.

"Dividend Champion" is a term orientated strategy referring to U.S Companies that have offered and increased their dividend for a minimum of 25 straight years.

A track record like this is incredibly encouraging to investors who know all to well that a company can cancel dividend payments at any time.

A consistent payment history is all the more important if the yield is competitively high. With this in mind we screened the 104 dividend champions, whose yields range from 0.50% to 5.06% and pulled the top 20 yielders.

Here are the 20 highest yielding Dividend Champions to compare with some essential fundamentals....

Subscribe to:

Posts (Atom)